Get Borrowers to Show Up and Handle Rate Objections Confidently

Reduce application no-shows, get live coaching for rate conversations, and automate document follow-up so you can close more loans.

The Challenges Mortgage Professionals Face

We understand the unique pain points in mortgage sales

Application No-Shows

Borrowers don't show up for scheduled application calls, slowing down your pipeline and wasting valuable time. Loan officers report no-show rates of 25-40% for application appointments, representing hundreds of thousands in potential loan volume lost monthly.

Handling Rate Shoppers

Borrowers are comparing rates with multiple lenders simultaneously. You need confident answers about market timing, rate locks, and the true cost of waiting. Every hesitation gives competitors an opening to steal your deal.

Competitive Market Pressure

In today's fast-moving market, the most responsive loan officer wins. Borrowers expect immediate responses and seamless communication, but manually following up while managing a full pipeline is overwhelming. Speed kills deals you don't have.

How Appendment Powers Your Mortgage Sales Process

Borrower Context and Reminders

Get comprehensive context on previous interactions, borrower financial profile, property details, and loan scenario before every call. Automated application reminders via email and SMS significantly reduce no-shows. Know exactly where each borrower stands in their home buying journey and what concerns they've expressed.

Live Coaching for Rate Objections

SalesPilot helps you handle rate objections and create urgency during calls with real-time guidance. Get prompts for explaining rate lock strategies, comparing loan products, discussing closing costs, and addressing borrower concerns about market timing. Speak with confidence even when rates are moving.

Application Follow-Up Automation

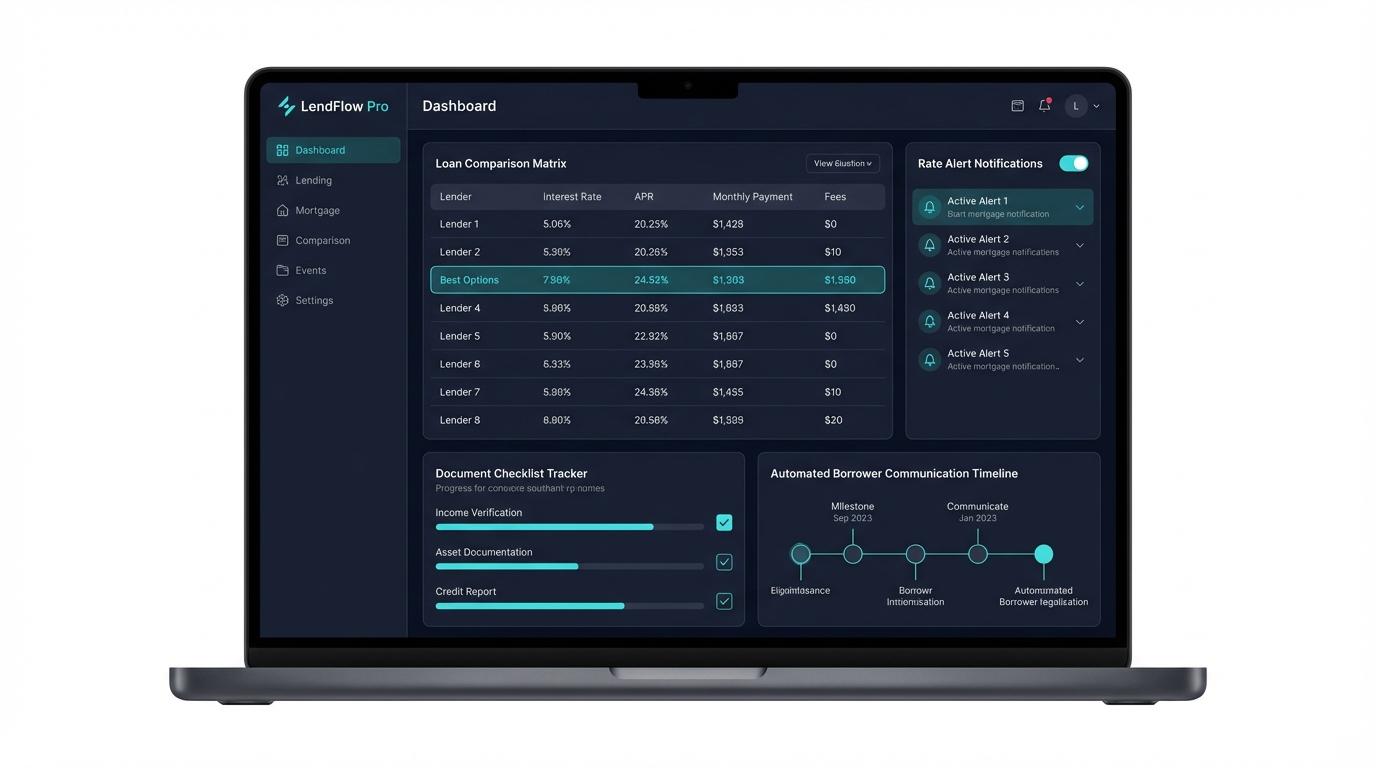

Automatically create CRM notes, send document request checklists, and schedule follow-up tasks to keep deals moving toward closing. Trigger rate alert notifications, send pre-approval letters, and maintain consistent communication throughout the loan process without manual effort.

Everything You Need to Win in Mortgage

Before Your Calls

- Borrower context and financial profile summary

- Previous interactions and conversation history

- Application reminder sequences via SMS and email

- Property and loan scenario details

- Rate sheet and product option prep

- Document checklist status tracking

- Competitive rate intelligence

During Your Calls

- Coaching on handling rate objections

- Guidance on creating urgency in rising rate markets

- Help answering complex borrower questions

- Product comparison frameworks

- Closing cost explanation assistance

- Live transcription and note-taking

- Rate lock strategy suggestions

After Your Calls

- Automatic CRM updates with call notes

- AI-generated conversation summaries

- Document request and reminder sequences

- Rate alert notifications

- Pre-approval letter automation

- Closing timeline management

- Pipeline tracking and forecasting

Understanding Mortgage Sales in Today's Market

The mortgage industry operates in one of the most competitive and rate-sensitive environments in all of sales. Today's borrowers have access to instant rate comparisons from dozens of lenders, and a difference of just a few basis points can determine who wins the loan. At the same time, rising rates and reduced refinance volume have made purchase business more important than ever, intensifying competition for every qualified borrower. The loan officers who succeed in this environment are those who combine deep product knowledge with exceptional responsiveness and relationship-building skills. Speed matters more than ever - studies show that the first lender to make meaningful contact with a borrower wins the deal more than 60% of the time. Yet many loan officers struggle to balance the administrative demands of managing active loans with the responsiveness required to capture new business. Technology has become essential for maintaining competitive advantage.

The Real Challenges Facing Mortgage Professionals

Mortgage loan officers face a unique combination of challenges that make consistent production difficult. Rate conversations are inherently stressful, as borrowers often focus obsessively on rate without understanding the total cost picture, and rates can move significantly during a single day. This requires loan officers to balance honesty about market conditions with creating appropriate urgency to move forward. The documentation requirements of mortgage lending add another layer of complexity - managing document collection from multiple parties while keeping the loan moving toward closing demands exceptional organization. Meanwhile, compliance requirements mean every communication must be carefully considered. Many loan officers find themselves spending more time on paperwork and follow-up than on actually talking to borrowers, leading to missed opportunities and frustrated customers who feel like just another file in the pipeline.

How Appendment Transforms Your Mortgage Sales Process

Appendment provides mortgage loan officers with AI-powered tools designed specifically for the unique challenges of mortgage sales. Our intelligent reminder system dramatically reduces no-shows by sending optimized appointment confirmations that reinforce the borrower's commitment. During calls, SalesPilot provides real-time coaching that helps you explain rate dynamics confidently, compare loan products clearly, and create appropriate urgency without being pushy. After each interaction, our automation handles document follow-up, rate notifications, and pipeline management automatically. The result is a systematic approach to mortgage sales that helps loan officers close more loans while providing the responsive, personalized service that today's borrowers demand.

Why Mortgage Teams Choose Appendment

- Purpose-built for mortgage sales with industry-specific coaching for rate objections and product comparisons

- Reduces application no-shows by up to 35% with intelligent reminder sequences

- Real-time coaching helps loan officers handle rate conversations with confidence

- Automatic document follow-up keeps loans moving toward closing

- Integrates with major mortgage CRMs and LOS platforms including Encompass and Byte

- Rate alert automation keeps borrowers engaged throughout the rate shopping process

- Pipeline management dashboards provide visibility into loan progress and bottlenecks

- Proven to increase funded loan volume by helping loan officers close more of their qualified leads

The ROI of AI-Powered Mortgage Sales

Real results from mortgage teams using Appendment

Intelligent reminder sequences ensure more borrowers attend their scheduled application calls

Better follow-up and rate objection handling help loan officers close more deals

Automation handles document follow-up and CRM updates automatically

Frequently Asked Questions About Mortgage Sales Automation

Get answers to common questions about using Appendment for mortgage sales

Ready to Transform Your Mortgage Sales?

See how Appendment can help you close more deals in mortgage