Get More Prospects to Show Up and Handle Objections with Confidence

Reduce appointment no-shows, get real-time coaching during calls, and automate your follow-up so you can focus on closing policies.

The Challenges Insurance Professionals Face

We understand the unique pain points in insurance sales

Appointment No-Shows

Prospects don't show up for scheduled calls, wasting your time and killing your pipeline momentum. Insurance agents report no-show rates of 30-45% for policy review appointments, costing agencies tens of thousands in potential premium annually.

Stumbling on Objections

When prospects push back on premiums, coverage details, or ask about competitors, you need confident answers in the moment to keep the conversation moving forward. Hesitation costs policies and damages credibility.

Inconsistent Follow-Up

After calls end, manual CRM updates and follow-up tasks pile up endlessly. Leads slip through the cracks while you're quoting or handling claims. Most agencies lose 25-35% of potential policies simply due to poor follow-up.

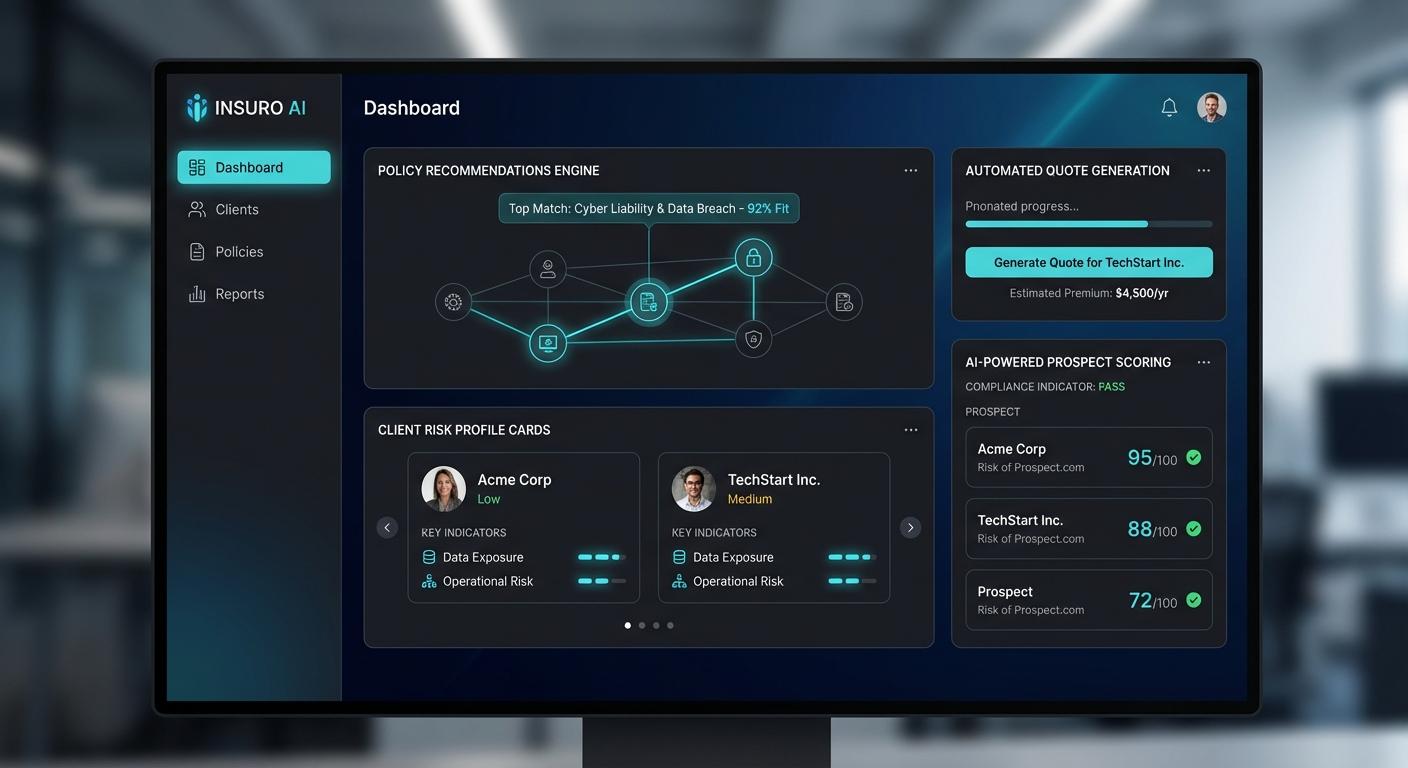

How Appendment Powers Your Insurance Sales Process

Get Prospects to Show Up

Automated appointment reminders via email and SMS significantly reduce no-shows. Before each call, review lead intelligence including current coverage, family situation, recent life events, and previous conversation history. Walk into every call prepared to demonstrate you understand their specific insurance needs.

Live AI Coaching During Calls

SalesPilot listens to your calls and provides real-time guidance for handling objections about premiums, deductibles, and coverage levels. Get prompts for explaining policy benefits in relatable terms, addressing competitor comparisons, and moving conversations toward closing without being pushy.

Automated Follow-Up

CRM notes, call summaries, and follow-up tasks are automatically created so you can stay organized and move prospects forward. Trigger quote delivery sequences, schedule policy review reminders, and maintain consistent touchpoints throughout the sales cycle without manual effort.

Everything You Need to Win in Insurance

Before Your Calls

- Appointment reminder sequences via SMS and email

- Lead context including current coverage gaps

- Previous touchpoints and conversation history

- Life events and family situation triggers

- Prep notes for upcoming conversations

- Renewal and cross-sell opportunity alerts

- Competitive intelligence on current carriers

During Your Calls

- Live AI coaching for objection handling

- Real-time guidance on explaining coverage options

- Premium justification frameworks

- Competitor comparison responses

- Confidence boost for complex policy discussions

- Live transcription and note-taking

- Closing technique suggestions

After Your Calls

- Automatic CRM note creation

- AI-generated call summaries and action items

- Follow-up task automation

- Quote delivery and reminder sequences

- Policy review scheduling

- Rep performance feedback and coaching

- Pipeline tracking and forecasting

Understanding Insurance Sales in Today's Market

The insurance industry is undergoing a significant transformation driven by changing consumer expectations and increased competition. Today's insurance buyers are more informed than ever, comparing quotes online and expecting the same personalized, convenient experience they get from other service providers. At the same time, carriers are pushing for higher production numbers while commission structures continue to compress. Independent agents and captive producers alike face pressure to close more policies with less margin for error. The agents who succeed in this environment are those who combine deep product knowledge with excellent communication skills and systematic follow-up processes. Technology has become essential - not to replace the trusted advisor relationship that defines great insurance sales, but to enhance it by ensuring every prospect receives timely, personalized attention throughout their buying journey.

The Real Challenges Facing Insurance Professionals

Insurance sales professionals face a complex set of challenges that make consistent production difficult. The intangible nature of insurance products means you're selling peace of mind and future protection rather than something prospects can see or touch. This requires strong consultative skills to help prospects understand the value of adequate coverage before they experience a loss. Price objections are constant, as many prospects view insurance primarily as a commodity and struggle to see the difference between carriers. Meanwhile, the administrative burden of maintaining accurate CRM records, generating quotes, and following up with all prospects consistently can be overwhelming. Many agents find themselves spending more time on paperwork than on actual selling, leading to inconsistent production and frustrated customers who feel neglected.

How Appendment Transforms Your Insurance Sales Process

Appendment provides insurance professionals with AI-powered tools designed specifically for the unique challenges of selling protection products. Our intelligent reminder system dramatically reduces no-shows by sending optimized appointment confirmations and reminders. During calls, SalesPilot provides real-time coaching that helps you explain coverage clearly, justify premiums confidently, and handle objections about price and competitors effectively. After each interaction, our automation handles CRM updates, triggers appropriate follow-up sequences, and schedules next steps automatically. The result is a systematic approach to insurance sales that helps every agent perform like a top producer while spending more time actually talking to prospects.

Why Insurance Teams Choose Appendment

- Purpose-built for insurance sales with industry-specific objection handling for premiums, deductibles, and coverage

- Reduces appointment no-shows by up to 40% with multi-channel reminder sequences

- Real-time coaching helps new agents sound like experienced producers from day one

- Automatic CRM updates save 30-45 minutes daily on administrative tasks

- Integrates with major insurance platforms including Applied Epic, Hawksoft, and AgencyZoom

- AI-generated follow-up maintains consistent touchpoints throughout the quoting process

- Manager dashboards provide visibility into team performance and coaching opportunities

- Proven to increase policy production by helping agents close more of their quoted prospects

The ROI of AI-Powered Insurance Sales

Real results from insurance teams using Appendment

Intelligent reminder sequences ensure more prospects attend their scheduled appointments

Better follow-up and objection handling help agents close more of their quoted prospects

Agents using Appendment consistently produce more premium per month

Frequently Asked Questions About Insurance Sales Automation

Get answers to common questions about using Appendment for insurance sales

Ready to Transform Your Insurance Sales?

See how Appendment can help you close more deals in insurance